Who needs this tax return?

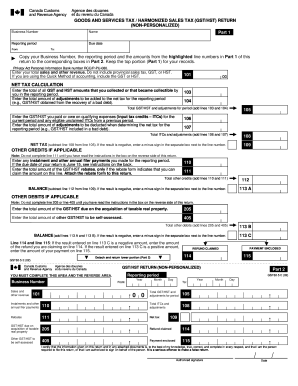

This is a form requested from big companies, small businesses and entrepreneurs by the Canada Revenue Agency. They need to file this tax return if they provide services or sell goods on Canadian territory.

What is this tax return for?

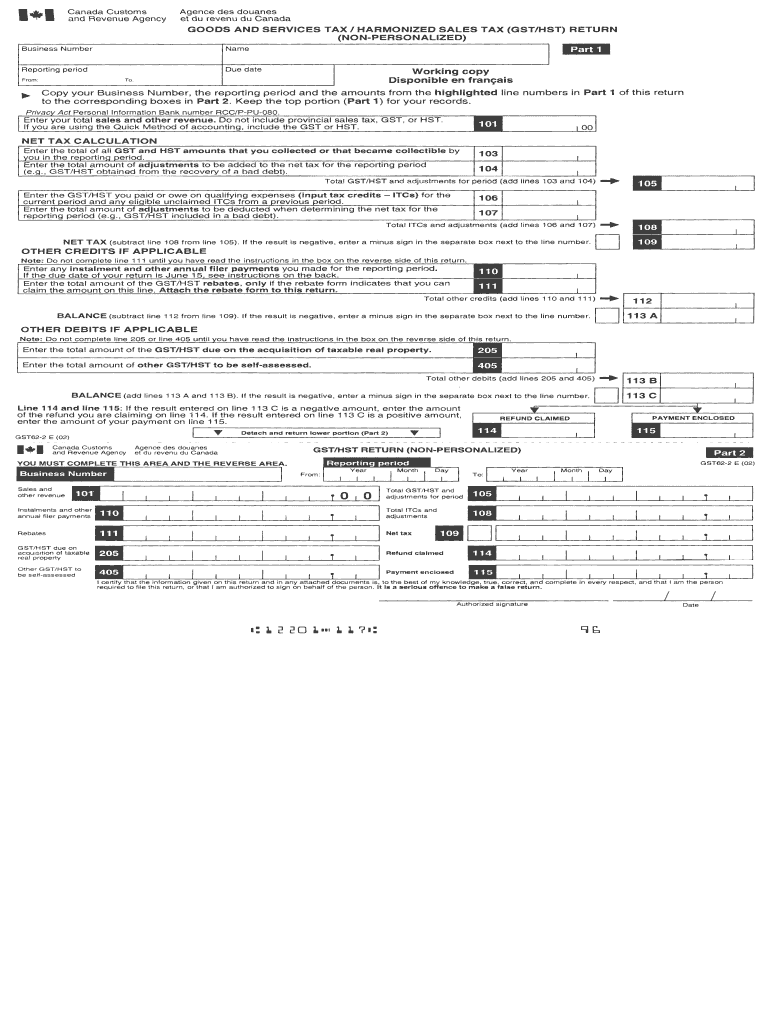

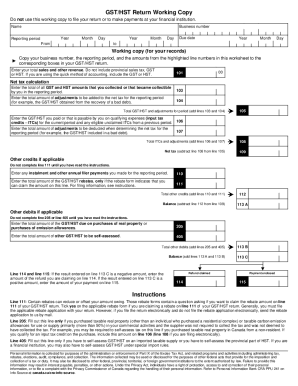

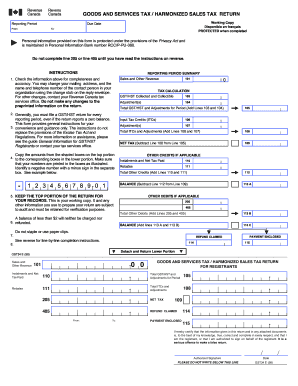

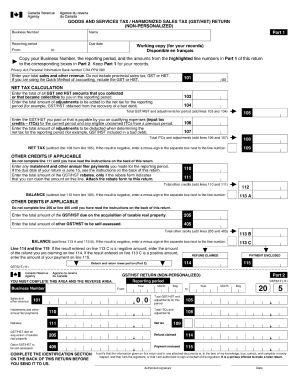

This a report for the CRA where businesses have to include GST (goods and services tax), HST (harmonized sales tax), ITC's (input tax credits), adjustments, and net tax. Net tax is calculated as a difference between GST/HST (taxes withheld from customers) and ITC (business expenses and necessary purchases).

Is it accompanied by other forms?

It does not require addenda, however it would be smart to keep evidence of your payments. They will be of great help whenever you need to verify the amounts you report to CRA.

When is this return due?

The CRA representatives will appoint the period depending on the annual income. If the business entity receives $1,5M a year or less, it needs to file this return at the end of the tax year. If its income is more than $1,5M but less than $6M, the company should file a tax return quarterly. For every business that makes more than $6M a year returns are expected every month.

How do I fill out goods and services tax return?

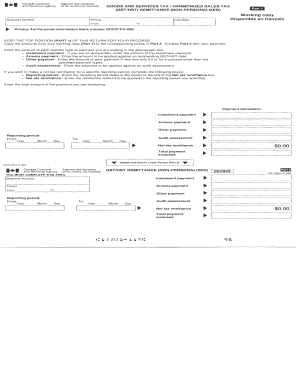

All the necessary fields are located in the bottom of this return. Use the upper part for calculation as a draft and when you learn the correct amounts, transfer them to the lower part of the document. Don’t write anything on the back of the form, and keep the top portion for your records.

Where do I send it?

File your returns with CRA electronically. Visit CRA official website to learn more details.